souzka.ru Overview

Overview

Face Value Of Apple Stock

See today's Apple stock price (NASDAQ: AAPL), related news, stock ratings, valuation, dividends and more to help you make your investing decisions. Apple's market cap is calculated by multiplying AAPL's current stock price of $ by AAPL's total outstanding shares of 15,,, © WallStreetZen. Find the latest Apple Inc. (AAPL) stock quote, history, news and other vital information to help you with your stock trading and investing. Stock analysis for Apple Inc (AAPL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. As of , the Fair Value of Apple Inc (AAPL) is USD. This value is based on the Peter Lynch's Fair Value formula. With the current market price of. Key Stats ; PE Ratio, ; PE Ratio (Forward) · Upgrade ; PS Ratio, ; Price to Book Value, The latest Apple stock prices, stock quotes, news, and AAPL history to help you invest and trade smarter. The week high price of Apple Inc (AAPL) is $ The week low price of Apple Inc (AAPL) is $ Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. See today's Apple stock price (NASDAQ: AAPL), related news, stock ratings, valuation, dividends and more to help you make your investing decisions. Apple's market cap is calculated by multiplying AAPL's current stock price of $ by AAPL's total outstanding shares of 15,,, © WallStreetZen. Find the latest Apple Inc. (AAPL) stock quote, history, news and other vital information to help you with your stock trading and investing. Stock analysis for Apple Inc (AAPL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. As of , the Fair Value of Apple Inc (AAPL) is USD. This value is based on the Peter Lynch's Fair Value formula. With the current market price of. Key Stats ; PE Ratio, ; PE Ratio (Forward) · Upgrade ; PS Ratio, ; Price to Book Value, The latest Apple stock prices, stock quotes, news, and AAPL history to help you invest and trade smarter. The week high price of Apple Inc (AAPL) is $ The week low price of Apple Inc (AAPL) is $ Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC.

Price/Sales, , ; Price/Book, , ; Enterprise Value/Revenue, , ; Enterprise Value/EBITDA, , Buy Apple, Inc. Shares from India at ₹19K (as on ). Start investing in Apple, Inc. now with fractional investing only on INDmoneyapp. The all-time high Apple stock closing price was on July 16, · The Apple week high stock price is , which is % above the current share. Summary of all time highs, changes and price drops for Apple. Historical stock prices ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta, ; 11 Month. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Apple Inc. ; Price Momentum. AAPL is trading near the top ; Price change. The price of AAPL shares has increased $ ; Closed at $ The stock has since. Valuation Measures ; Price/Sales, , ; Price/Book, , ; Enterprise Value/Revenue, , ; Enterprise Value/EBITDA, , Apple went public on December 12, at $ per share. The stock has split five times since the IPO, so on a split-adjusted basis the IPO share price was $. The current price to book ratio for Apple as of August 23, is Please refer to the Stock Price Adjustment Guide for more information on our. Face value means the base value at which the capital was raised for the stock. The Face value could be Rs , , 10, 5, 2 or Rs 1. The rest. Apple · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (% YoY). The current price of AAPL is USD — it has increased by % in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. Apple (AAPL) Stock Price Today: $ + (%) The closing share price for Apple (AAPL) stock was $ for Friday, August 23 , up % from the. Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of. Market Capitalization, $K 3,,, · Shares Outstanding, K 15,, · Annual Sales, $ , M · Annual Income, $ 96, M · Month Beta · Price/Sales. Market Value, $T ; Shares Outstanding, B ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Apple Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time AAPL stock price. The price of a security measures the cost to purchase 1 share of a security. For a company, price can be multiplied by shares outstanding to find the market. The intrinsic value of one AAPL stock under the Base Case scenario is USD. Compared to the current market price of USD, Apple Inc is Overvalued by.

Kinds Of Real Estate

11 real estate strategies investors need to know · 1. Invest in single-family rental (SFR) properties · 2. House hacking · 3. Flipping properties · 4. Live-in flip. Commercial real estate is a broad term that encompasses a variety of property types, from retail stores and industrial warehouses to office buildings and. The 5 Types of Real Estate Investments · Residential Investing · Commercial Investing · Raw Land · Third-Party (Crowdfunding, Fractional, REITs, etc.). Owning their own property is the most exclusive type of an upscale lifestyle. Depending on capital strength, investment properties ranging from condominiums to. Understand the different types of real estate for owning, renting, or investing, from homes to condos, and how townhomes are unique. While real estate presents itself in multifaceted forms, the heart of its diversity lies in four core categories: residential, commercial, industrial, and land. Overview of Real Estate Industry · Development · Sales and marketing · Brokerage · Property management · Lending · Professional services (law, accounting, etc.). Residential real estate · Bungalows · Split-level home · Mansions · Villas · Detached house or single-family detached house · Cottages. 9 Different Types of Real Estate Deals for Investors · Wholesaling · Wholetailing · Double-Closing · Flipping · Long-Term Rentals · Short-Term Rentals. 11 real estate strategies investors need to know · 1. Invest in single-family rental (SFR) properties · 2. House hacking · 3. Flipping properties · 4. Live-in flip. Commercial real estate is a broad term that encompasses a variety of property types, from retail stores and industrial warehouses to office buildings and. The 5 Types of Real Estate Investments · Residential Investing · Commercial Investing · Raw Land · Third-Party (Crowdfunding, Fractional, REITs, etc.). Owning their own property is the most exclusive type of an upscale lifestyle. Depending on capital strength, investment properties ranging from condominiums to. Understand the different types of real estate for owning, renting, or investing, from homes to condos, and how townhomes are unique. While real estate presents itself in multifaceted forms, the heart of its diversity lies in four core categories: residential, commercial, industrial, and land. Overview of Real Estate Industry · Development · Sales and marketing · Brokerage · Property management · Lending · Professional services (law, accounting, etc.). Residential real estate · Bungalows · Split-level home · Mansions · Villas · Detached house or single-family detached house · Cottages. 9 Different Types of Real Estate Deals for Investors · Wholesaling · Wholetailing · Double-Closing · Flipping · Long-Term Rentals · Short-Term Rentals.

This included categories range from townhouses, single-family homes, condominiums, multi-family properties, cooperatives, and duplexes. Learn how to maximize your ROI potential when real estate investing and explore the benefits of investing with different property types. Real estate is defined as the land and any permanent structures, like a home, or improvements attached to the land, whether natural or man-made. In this article, we will delve into the four main types of real estate – land, residential, commercial, and industrial – and explore the investment strategies. Understand the different types of real estate for owning, renting, or investing, from homes to condos, and how townhomes are unique. Overview of Real Estate Industry · Development · Sales and marketing · Brokerage · Property management · Lending · Professional services (law, accounting, etc.). Most real estate ownerships with more than one owner are tenants in common, and the court generally favors this type of co-ownership over a joint tenancy. From an assignment of contract that allows you to move quickly to your next deal, to building a portfolio of long-term rentals, here are 9 types of real estate. Let's have a look at the three major categories of investors in the market. Speculators: These are the kinds of investors that should not be called “investors”. In this comprehensive guide, we will walk you through the primary avenues of real estate investment, providing insights to help you make informed decisions. Here's what you need to know about the different types, how they work, the pros and cons of investing widely or narrowly in real estate. A guide to the 5 types of real estate. Written by MasterClass. Last updated: Jun 10, • 3 min read. There are many different kinds of real estate used for. Real estate property is an asset class that plays a significant role in many investment portfolios and is an attractive source of current income. Real estate investment strategies vary widely, from residential rental properties to commercial real estate and raw land, each with unique benefits and. This included categories range from townhouses, single-family homes, condominiums, multi-family properties, cooperatives, and duplexes. The best real estate investments for beginner and part-time independent investors are single-family housing and small multifamily residential properties. The “four basic food groups” in real estate are generally viewed as office, industrial, retail and multifamily. Each real estate property type (in the industry. Top real estate trends for · 1. Costs, deals and capital markets · 2. ESG strategy, reporting and performance · 3. A deepening affordability crisis as the. While real estate presents itself in multifaceted forms, the heart of its diversity lies in four core categories: residential, commercial, industrial, and land. Common Real Estate Specialties · Residential Homeowner · Residential Investment · Commercial Sales · Commercial Leasing · Agricultural · Property Manager · Residential.

Is It The Right Time To Invest In Stocks

The best time to invest in share market is when the market is falling as you can get a share at lower price and sell the shares when the market. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. This article reviews data to see what can happen if people invest at all-time highs in the stock market – and how often peaks were followed by major drops. Here's the question you face: Should you invest it all right away or in smaller increments over time, a strategy known as dollar-cost averaging? Dollar cost. Time in the stock market is better than timing the stock market. · Trying to time the market is difficult for even the savviest investors. · Consider your time. If things are going well, you may want to cash out and move on to the next investment. While changing strategies can be a good idea, it's better to base those. The time you're invested in the market is more important than investment timing. The longer you invest, the more you improve your chances of a positive. Experts often suggest that with a strategic, long-term plan, any time can be suitable for investing in stocks. And, all-time highs are not uncommon – so you would be missing out on a lot of opportunity if you tried to avoid them. In fact, since the broad U.S. equity. The best time to invest in share market is when the market is falling as you can get a share at lower price and sell the shares when the market. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions that. This article reviews data to see what can happen if people invest at all-time highs in the stock market – and how often peaks were followed by major drops. Here's the question you face: Should you invest it all right away or in smaller increments over time, a strategy known as dollar-cost averaging? Dollar cost. Time in the stock market is better than timing the stock market. · Trying to time the market is difficult for even the savviest investors. · Consider your time. If things are going well, you may want to cash out and move on to the next investment. While changing strategies can be a good idea, it's better to base those. The time you're invested in the market is more important than investment timing. The longer you invest, the more you improve your chances of a positive. Experts often suggest that with a strategic, long-term plan, any time can be suitable for investing in stocks. And, all-time highs are not uncommon – so you would be missing out on a lot of opportunity if you tried to avoid them. In fact, since the broad U.S. equity.

Equities can add diversification and serve as a growth engine to help build value over time: Higher growth potential — Equities serve as a cornerstone for many. Friday would typically be the best day of the week to sell stock, especially if the Friday under consideration begins a longer than usual 3-day weekend. Stock. The Calendar Effect · September You Are The Worst · October Not So Scary (Halloween Effect) · January We love You Baby · So Should We Invest In Stocks Based On The. This can mean much lower returns on Monday than there were to be had on Friday, making Monday traditionally known as a good day of the week to snaffle up. If Monday may be the best day of the week to buy stocks, then Thursday or early Friday may be the best day to sell stock—before prices dip. If you're interested. You should be prepared to invest for at least 5 years to give you a chance to ride out any short-term fluctuations. Historically, markets tend to rise over time. The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. Dividend stocks are popular among older investors because they produce a regular income, and the best stocks grow that dividend over time, so you can earn more. For stocks to be the better investment, investors will need to be right now,” Mueller-Glissmann says. There's an argument that stocks are less. You can play the long game. Stocks can be particularly appealing to younger investors for a number of reasons. For one, you have more time to recoup potential. For most investors, a buy-and-hold strategy can result in quicker loss recovery, even after a bear market, when a major index like the S&P falls by more. Historically, investors have experienced better results by staying invested in the stock market rather than trying to time it. The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With. Investing is all about playing the long game – that's at least five years, but ideally a lot longer. Taking a long-term approach with your investments helps cut. good time to buy a house or should I wait? Remortgaging in Should I Should I invest in a cash Isa or stocks and shares Isa? While a cash ISA. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another. Market timing is when you move your money in and out of equities to try and capture the performance highs and avoid the lows. It's extremely risky, and even the. Invest for the Long-Term. The stock market is known for its volatility, and short-term fluctuations in stock prices can be significant. To. Explore factors determining the right time to invest in stocks. Gain insights for strategic decision-making in the dynamic financial market. If an investor holds onto an underperforming stock or is lagging the overall market, it may be time to sell that stock and put the money to work in another.

Speculative Stock

Speculative Limits. To protect futures markets from excessive speculation that can cause unreasonable or unwarranted price fluctuations, the Commodity Exchange. Speculative Management: Stock Market Power and Corporate Change (SUNY series in. Be the first towrite a review. Midtown Scholar Bookstore (); A speculative stock is a company that is characterized by extreme risk with the possibility of extreme returns in compensation for that risk. These stocks are. Breakeven stock price at expiration. Strike price plus premium paid. In this example: + = Profit/Loss diagram and. The causes of the stock market crash: a speculative orgy or a new era? Responsibility: Harold Bierman, Jr. Imprint: Westport, Conn.: Greenwood Press. Speculative growth stocks · 1. Ksolves India, , , , , , , , , , · 2. Basilic Fly Stud, POET, photonic microchips. If they are even somewhat successful you are looking at to x return. Throughout the s a long boom took stock prices to peaks never before seen. From to stocks more than quadrupled in value. Many investors became. In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the. Speculative Limits. To protect futures markets from excessive speculation that can cause unreasonable or unwarranted price fluctuations, the Commodity Exchange. Speculative Management: Stock Market Power and Corporate Change (SUNY series in. Be the first towrite a review. Midtown Scholar Bookstore (); A speculative stock is a company that is characterized by extreme risk with the possibility of extreme returns in compensation for that risk. These stocks are. Breakeven stock price at expiration. Strike price plus premium paid. In this example: + = Profit/Loss diagram and. The causes of the stock market crash: a speculative orgy or a new era? Responsibility: Harold Bierman, Jr. Imprint: Westport, Conn.: Greenwood Press. Speculative growth stocks · 1. Ksolves India, , , , , , , , , , · 2. Basilic Fly Stud, POET, photonic microchips. If they are even somewhat successful you are looking at to x return. Throughout the s a long boom took stock prices to peaks never before seen. From to stocks more than quadrupled in value. Many investors became. In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the.

Speculative trading is a form of trading where traders look to profit from market price movements - whether the market goes up or down. It stands in contrast to. Never before have so many bought and sold so much so often. So far this year, the New York Stock Exchange has traded million shares of stock —more than. Download Citation | Speculative Trading and Stock Prices: Evidence from Chinese A-B Share Premia | The market dynamics of technology stocks in the late. Even absent speculative practic- es, real estate investment can In Blackstone sold off its shares in Invitation. Homes, taking home $ A speculative stock is a stock that a trader uses to speculate. The stock is considered as being very hazardous and trading at a relatively low price because. Never before have so many bought and sold so much so often. So far this year, the New York Stock Exchange has traded million shares of stock —more than. In finance, speculation is the purchase of an asset with the hope that it will become more valuable shortly. It can also refer to short sales in which the. Both speculation and gambling involve taking a high risk for a high potential reward, and either winning or losing within a very short time frame. Additionally. Speculative trading refers to buying and selling financial instruments, such as stocks, currencies, commodities, and derivatives, to generate short-term. Successful speculative investment;: A non-technical treatise on the stock market, speculation and investment, aimed to overcome the obstacles and point the way. souzka.ru: STOCK MARKET CRASHES AND SPECULATIVE MANIAS (The International Library of Macroeconomic and Financial History series, 13): White. SPECULATIVE INVESTMENT definition: an investment that carries a high FINANCE, STOCK MARKET. uk. Your browser doesn't support HTML5 audio. us. Your. Breakeven stock price at expiration. Strike price plus premium paid. In this example: + = Profit/Loss diagram and. SPECULATIVE INVESTMENT definition: an investment that carries a high FINANCE, STOCK MARKET. uk. Your browser doesn't support HTML5 audio. us. Your. The penny stock market is mostly composed of speculative, low-priced securities. Even penny stocks listed on major exchanges can be highly volatile. Penny. Speculation, where investors purchased into high-risk schemes that they hoped would pay off quickly, became the norm. Several banks, including deposit. Learn about the risks of penny stocks and speculative stock investments and how this market works. Speculation in the Stock Market. Stocks that are considered highly risky in the stock market are known as speculative stocks. Speculative stocks offer. Speculative Limits. To protect futures markets from excessive speculation that can cause unreasonable or unwarranted price fluctuations, the Commodity Exchange.

How Much Are Financial Advisor Fees

How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. In a survey of nearly 1, advisors by Bob Veres' Inside Information, the typical financial advisory fee up to $1 Million in assets under management is 1%. It. That fee can range from % to 1% per year or more, and it compounds over time. Use this tool to explore how much your advisor could cost you over the life of. More than 1% is too much to pay a financial advisor. This is your hard-earned money. Hold onto it. Ask your financial advisor questions. Lots of them! Pay Less. The fees charged by a competent investment advisor are no different than those charged by a good accountant or an attorney. You are simply paying for a service. The commission is usually based on a percentage of what you pay for the product. Your adviser can't receive a commission on superannuation products or. The total fee could range from $2, to $5, on various projects such as generating an estate plan for a client. Flat Fees. Financial advisors who charge a. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. In a survey of nearly 1, advisors by Bob Veres' Inside Information, the typical financial advisory fee up to $1 Million in assets under management is 1%. It. That fee can range from % to 1% per year or more, and it compounds over time. Use this tool to explore how much your advisor could cost you over the life of. More than 1% is too much to pay a financial advisor. This is your hard-earned money. Hold onto it. Ask your financial advisor questions. Lots of them! Pay Less. The fees charged by a competent investment advisor are no different than those charged by a good accountant or an attorney. You are simply paying for a service. The commission is usually based on a percentage of what you pay for the product. Your adviser can't receive a commission on superannuation products or. The total fee could range from $2, to $5, on various projects such as generating an estate plan for a client. Flat Fees. Financial advisors who charge a. Fee-Only planners are compensated directly by their clients for advice, plan implementation and for the ongoing management of assets. All NAPFA members are. The current industry standard is to charge anywhere from % – 2% of the assets being managed on an annual basis. Most advisors will fall somewhere around the.

A fee-only financial advisor might charge a flat fee, normally from $1, to $5, They may charge hourly fees of $ to $, or a percentage fee, normally. Financial advisors typically charge 1% of assets they manage. Financial advisor fees can be expensive, but they can also save you a lot of money in the long run. Hourly fees can range anywhere from $ to $ per hour, so how much a financial advisor costs varies dramatically. It depends on the complexity of your. How they're getting paid determines how much that financial advisor costs. How Much Does a Financial Advisor Cost? Generally speaking, 1% per year is a. Commissions and sales charges when you buy and sell investments, generally ranging from % to %, which may be lower and vary based on the type and amount. This fee structure causes fees to grow exponentially as your wealth increases. For example, assume you have $3,, invested with a traditional Wall Street. Financial advisor fees are charges you pay for professional advice and management of your financial planning and investment portfolio. These fees can vary. Wells Fargo Advisors Fees vary by relationship type and services provided. Learn about investment advisory services, brokerage and related fees Many of them. The typical starting point for advisory fees is 1%, which means the advisor needs to provide 1% or more value to clients to earn their fees. That can be tough. Charges can vary depending on the type of advice you are getting. Financial advisers generally get paid by: Commission – Where a financial adviser receives. Most financial advisors charge a fee based on a fixed percentage of the total value of your investment portfolio. The industry-average is 1% of your portfolio. How Much Does a Financial Advisor Cost? · What to Know About Financial Advisor Costs · Assets Under Management (AUM) · Flat Fee Retainer · One Time Plan · Ask The. Advisors who charge a 1% annual fee typically offer asset management. If you get additional services on top of investment management services, the fee might be. According to Advisor Ratings, the average cost of a financial advisor is about $3, As with any profession, this can increase to upwards of $30, depending. The advisory fee typically ranges from % of the amount invested; the rate is generally influenced by asset size and services provided. Fees can vary, but they typically start in the $1, to $2, range and can go up to $5, to $6, or more a year. The complexity of your personal. The cost of business financial planning ranges between $90 and $ per hour, with an average cost of $ per hour. There is a large variation in. The advisory fee typically ranges from % of the amount invested; the rate is generally influenced by asset size and services provided. Financial advisors often charge an Assets Under Management (AUM) fee - usually 1%. That means you pay your advisor a percentage of your accounts. As your money. In this article, we bring you various methods financial advisers use to bill for their services, along with their fees and charges.

250k House On 60k Salary

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. The amount you'll pay up front for your house. Your down payment will vary depending on your home price: If you're buying a home valued up to $,, your. The general guideline is that a mortgage should be two to times your annual salary. A $60, salary equates to a mortgage between $, and $, house and other bad things. As with property taxes, you pay roughly one-twelfth of your annual premium each month, and the servicer pays the bill when it's due. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. In , Florida passed House Bill 87, known. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. More from SmartAsset. How much house can you afford? Calculate your monthly mortgage payment · Calculate your closing costs · Should you rent or buy? Consider all your earnings for the year, which could include salary, wages, tips, commission, etc. If you have a spouse or a partner that has an income. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. The amount you'll pay up front for your house. Your down payment will vary depending on your home price: If you're buying a home valued up to $,, your. The general guideline is that a mortgage should be two to times your annual salary. A $60, salary equates to a mortgage between $, and $, house and other bad things. As with property taxes, you pay roughly one-twelfth of your annual premium each month, and the servicer pays the bill when it's due. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. In , Florida passed House Bill 87, known. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. More from SmartAsset. How much house can you afford? Calculate your monthly mortgage payment · Calculate your closing costs · Should you rent or buy? Consider all your earnings for the year, which could include salary, wages, tips, commission, etc. If you have a spouse or a partner that has an income.

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. But your DTI is also a crucial factor in figuring out how much house you can truly afford. For starters, you could ask for a raise in salary or you could work. pay in relation to your principal and your overall equity toward the remaining balance. For those looking to secure a Texas land mortgage, our land loan. pay off the home loan in full. If you're unsure which term length is right for you, explore different home loan options before using the house payment. To afford a house that costs $, with a down payment of $50,, you'd need to earn $54, per year before tax. The mortgage payment would be $1, /. Use this calculator to better understand how much you can afford to pay for a house and what the monthly payment will be with a VA Home Loan. And with a conventional loan, you can use about 36% of that gross income. for your house payment. So that comes out to be $3, a month. But the trick is. you. WebBuying a house 6x your income is simply financially irresponsible and saving up 20% of a $, house in two years is not going to leave you any money. What mortgage can I afford on a £60k salary? What mortgage can I afford on a £70k salary? 04/ What salary do you need for a k house UK? Using the lending. Real estate taxes. The amount you expect to pay in property taxes. This is normally paid either semi-annually or annually. Hazard insurance. How Much House Can I Afford With A 60K Salary Bankrate hotsell, How Much how much money do i need to buy a k house · should i buy a new. a month in income, which is a 60 case salary. you can hold 50 of that amount. that's 2 for total housing expense. so on a loan at 5 down with a. This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. house or building. When you buy a home, you must pay real estate taxes, also known as property taxes, directly to your local tax assessor or indirectly as. Canada Mortgage Qualification Calculator. The first steps in buying a house are ensuring you can afford to pay at least 5% of the purchase price of the home. For example, if your gross salary is €80,, the maximum mortgage would be €, house price inflation. How much can I borrow? You can now borrow. salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you. Tired man at work thinking of a house. So I will make 60k a year, and have 50k savings. I live at my parents house. I was thinking to buy this house that costs k, and rent it out.

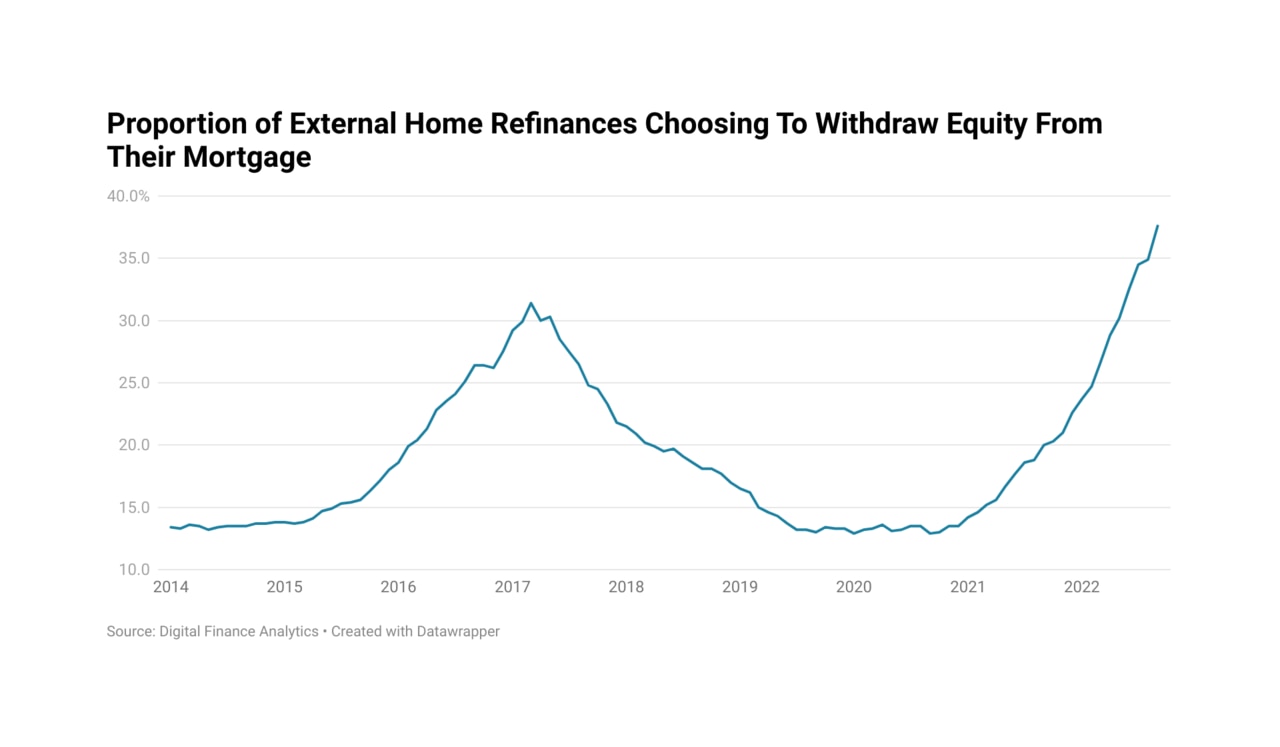

Home Equity Withdrawal

A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Tell me about the process – how long does it take? It can take less than 15 minutes to fill out an application for a home equity line from Truist. Once all. In economics, mortgage equity withdrawal (MEW) is the decision of consumers to borrow money against the real value of their houses. The real value is the. Expecting a large bill or expense? Lakeview can help you to tap into your home equity or convert it into cash with a Cash out refinance & Home Equity Loan. Home Equity line of credit can be used to pay for a variety of things including home renovations, consolidating debt, college tuition, major purchases and more. You would have to do a cash out refinance or a home equity loan. You can't just pull it out like a bank. A home equity loan — sometimes called a second mortgage — is a loan that's secured by your home. You get the loan for a specific amount of money and it must be. Mortgage Equity Withdrawal (MEW) is a financial strategy that allows homeowners to tap into the equity they have built up in their properties. Simply put, it. A HELOC is a line of credit guaranteed by the equity in your home. HELOCs are interest-only loans taken out over a specific period, for example, ten years. Most. A home equity line of credit (HELOC) lets you borrow against available equity with your home as collateral. Tell me about the process – how long does it take? It can take less than 15 minutes to fill out an application for a home equity line from Truist. Once all. In economics, mortgage equity withdrawal (MEW) is the decision of consumers to borrow money against the real value of their houses. The real value is the. Expecting a large bill or expense? Lakeview can help you to tap into your home equity or convert it into cash with a Cash out refinance & Home Equity Loan. Home Equity line of credit can be used to pay for a variety of things including home renovations, consolidating debt, college tuition, major purchases and more. You would have to do a cash out refinance or a home equity loan. You can't just pull it out like a bank. A home equity loan — sometimes called a second mortgage — is a loan that's secured by your home. You get the loan for a specific amount of money and it must be. Mortgage Equity Withdrawal (MEW) is a financial strategy that allows homeowners to tap into the equity they have built up in their properties. Simply put, it. A HELOC is a line of credit guaranteed by the equity in your home. HELOCs are interest-only loans taken out over a specific period, for example, ten years. Most.

A home equity loan borrows against the equity built in your home. Home equity can be accessed in the form of a loan or a line of credit. If you are a planning a. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general. A home equity line of credit (HELOC) is a secured loan tied to your home that allows you to access cash as you need it. Home Equity Loan. The available funds can be used as needed; the borrower does not have to reapply for another loan every time a withdrawal is made. The. Home equity line of credit (HELOC) lets you withdraw from your available line of credit as needed during your draw period, typically 10 years. During this time. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. Rates as low as % APR · Up to $1, towards your closing costs · Choose a home equity line of credit (HELOC) or a home equity loan · Lending professionals. Mortgage Equity Withdrawal (MEW) is a financial strategy that allows homeowners to tap into the equity they have built up in their properties. Simply put, it. A home equity line of credit (HELOC) from Bank of America is a flexible financing solution, secured by the equity in your home, to help pay for the things that. Home Equity Loan · Home equity loans are often used for one-time expenses (home improvements, major purchases, etc.). · Home equity loans often come with fixed. A home equity loan is similar to a cash out refinance, because you get a lump sum of money at closing. A home equity loan is a separate, second loan on your. What is a Mortgage Equity Withdrawal? Mortgage Equity Withdrawal (MEW) is a term that refers to a financial strategy in which homeowners extract cash from the. You can get a home equity line of credit, also known as a "HELOC." You can get a cash out refinance, where you replace your current mortgage with a new. Like a home equity loan, a HELOC lets you borrow against the equity in your home. The remaining value of the home provides your bank with insurance on your. Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value. Consumers shouldn't use home equity for luxury items like a fancy car, boat, big screen TV or a vacation. Typically, you can borrow up to 80% of the equity in your home. You will also need a good credit score and have made six consecutive on time payments on your. Avoid using it on anything that doesn't help improve your financial position in the long run. Never use your home equity line of credit to pay for basic. Cashing Out Equity On Home · You can borrow up to 80% of the value of your property, minus what you still owe on it, if you can provide a stated purpose (no. If you're considering pulling equity from your home, here are five ways you can do it, as well as the benefits and disadvantages of each.

How Much Is The Student Loan Interest Rate

Average student loan interest rates differ for federal and private loans. Find out what you might expect to pay, and how your loan compares to others. The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct. For undergraduate students, the interest rate for Direct Subsidized Loans and Direct Unsubsidized Loans is %. · For graduate or professional students, the. The current interest rate on Direct Unsubsidized Loan is % and the interest rate on the Graduate/Professional Plus Loan is %. In addition to an. Direct Loan interest rates and fees ; Undergraduate, Direct Subsidized, %, % ; Undergraduate, Direct Unsubsidized, %, %. Rates on year fixed-rate student loans averaged %, up from % last week and down from % a year ago. Rates hit a record low of % on Dec. They can have variable interest rates, sometimes higher than 10%. The interest rate, and your ability to receive private student loans, can depend on your. As of July, , all federal student loans have fixed interest for the life of the loan. Although rates are reevaluated by Congress every year, the interest. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan. Average student loan interest rates differ for federal and private loans. Find out what you might expect to pay, and how your loan compares to others. The federal student loan interest rates are currently % for undergraduate loans, % for unsubsidized graduate loans and % for direct. For undergraduate students, the interest rate for Direct Subsidized Loans and Direct Unsubsidized Loans is %. · For graduate or professional students, the. The current interest rate on Direct Unsubsidized Loan is % and the interest rate on the Graduate/Professional Plus Loan is %. In addition to an. Direct Loan interest rates and fees ; Undergraduate, Direct Subsidized, %, % ; Undergraduate, Direct Unsubsidized, %, %. Rates on year fixed-rate student loans averaged %, up from % last week and down from % a year ago. Rates hit a record low of % on Dec. They can have variable interest rates, sometimes higher than 10%. The interest rate, and your ability to receive private student loans, can depend on your. As of July, , all federal student loans have fixed interest for the life of the loan. Although rates are reevaluated by Congress every year, the interest. Key Takeaways · Interest rates are % for new federal undergraduate loans, % for graduate loans, and % for parent PLUS loans. · Private student loan.

Student Undergraduate Loan 10 Year Repayment ; Interest Rate · APR ; % · % ; % · %. MEFA's loans for undergraduate students offer five repayment options, no origination fee, application fee, or prepayment penalty, and fixed interest rates from. interest rate can be found on the monthly student loan bill. Loan Balance Cost Calculator to get a rough idea of how much college may cost. To. Direct PLUS Loans for graduate students and parents of undergraduate students: % (up from % in /24). This is the highest rate we've seen on the. The current federal student loan interest rate for undergraduates is %. · Graduate student and parent PLUS loans have fixed interest rates of % and %. Federal Direct Loan (FDL) – Interest Rates ; Undergraduate Subsidized & Unsubsidized. 7/1/ thru 6/30/ % ; 7/1/ thru 6/30/ % ; Graduate. To pay for your child's education, you borrowed $20, over four years. Assuming a % interest rate and starting repayment right after disbursement, you'd. Starting at % APR1,2. Nationally Recognized as One of the Best Education Loans. Simplify your student loan experience with RISLA. Federal Student Loan Interest Rates ; Direct Unsubsidized Loan (Undergraduate Students), %, % ; Direct Loan – Unsubsidized (Graduate/ Professional. Current Federal Student Loan Interest Rates ; % · % · % ; % · % · % ; % · % · % ; % · % · %. For loans taken out for the - school year, undergraduate students receive a % interest rate and graduate students receive a % interest rate. A. Direct Loans ; Undergraduate Students, %, %, % ; Undergraduate Students, %, %, %. Undergraduate students ; Federal Direct Subsidized Undergraduate Stafford Loan ; Lender, Federal government ; Interest Rate, % – loans disbursed between 7/1/. Federal Direct Loan Interest Rates ; Graduate PLUS, % Fixed for a graduate student enrolled at least half-time, % ; Parent PLUS, % Fixed for a parent. For the academic year, the interest rate on federal direct loans for undergraduate students is %. The current rate for graduate or professional. Your variable interest rate may increase or decrease, based on the day SOFR Average, resulting in an APR range between % and %. Fixed rate loans. Interest rate not to exceed % (for undergraduate students) and % (for graduate students). Repayment Term, Standard: 10 years. Many other options are. Federal student loan interest rates · Direct subsidized (undergraduate students): % · Direct unsubsidized (undergraduate students): % · Direct subsidized . Variable APR: A $10, loan with a year term ( monthly payments of $) and a % APR would result in a total estimated payment amount of.

How Much Should I Pay For A Car Payment

As a general rule, you should pay 20 percent of the price of the vehicle as a down payment. Individual auto loan rates will vary. Notes: In compiling. A down payment on a vehicle is a certain percentage of the total cost of the car that you pay upfront. Down payments are often anywhere from a minimum of 10%. I read online that most Americans average approximately $ a month for their car payment. Is that true? How do people afford that? This simple technique can shave time off your auto loan and could save you hundreds or even thousands of dollars in interest. Javascript is required for. Average Monthly Car Payments: Statistics at a Glance · The average monthly car loan payment for NEW VEHICLES has increased from $ (Q4 ) to $ (Q4 ). Payment Calculator · What price is the vehicle you're looking to buy? · How much are you looking to spend per payment? · Are you depositing a down payment? · How. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. You might be interested in: Lower your borrowing cost · Build a good credit history · How to choose a vehicle · The loan vs. lease decision. While some experts suggest your monthly payment (before other car-related costs such as gas and insurance) shouldn't exceed about 10% of your income, Footnote. As a general rule, you should pay 20 percent of the price of the vehicle as a down payment. Individual auto loan rates will vary. Notes: In compiling. A down payment on a vehicle is a certain percentage of the total cost of the car that you pay upfront. Down payments are often anywhere from a minimum of 10%. I read online that most Americans average approximately $ a month for their car payment. Is that true? How do people afford that? This simple technique can shave time off your auto loan and could save you hundreds or even thousands of dollars in interest. Javascript is required for. Average Monthly Car Payments: Statistics at a Glance · The average monthly car loan payment for NEW VEHICLES has increased from $ (Q4 ) to $ (Q4 ). Payment Calculator · What price is the vehicle you're looking to buy? · How much are you looking to spend per payment? · Are you depositing a down payment? · How. Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more. You might be interested in: Lower your borrowing cost · Build a good credit history · How to choose a vehicle · The loan vs. lease decision. While some experts suggest your monthly payment (before other car-related costs such as gas and insurance) shouldn't exceed about 10% of your income, Footnote.

According to our Car Loan Calculator, if you want to borrow $20, with average credit and decide to extend the term from 60 months to 84 months, it will lower. payment calculator to easily estimate and compare monthly payments on your next vehicle how much your trade-in will reduce the cost of your new vehicle. Our. How Much Should My Car Payment Be? A car loan is debt, and your total monthly debt payments should not be more than a third of your monthly take-home pay. Car buyers are making larger down payments as the cost of borrowing money increases. The average auto loan rate is now % APR for a new car loan, and %. The general rule of thumb is to put down at least 20% for a new car and 10% for a used car. But any size down payment can help lower your monthly payments and. Experian reports, Opens overlay that, as of the first quarter of , new vehicle owners paid an average of $ a month on their vehicles, while used car. for a 2 year insurance plan which means an average of Rs. a year. Then assuming you travel for around Kms a year (Average). The average car payment in the US is $ how in hell can people afford that? The Loan Amount (Principle) This is the total cost of the car including add-ons and other fees, minus your down payment amount. A Down payment is the amount. The typical down payment for a car is between 10% and 20% of the vehicle's total value. Used cars usually require down payments closer to 10%. Add together the total principal paid and total interest paid to see the total overall cost of the car. How Is Interest Calculated on a Car Loan? An auto loan. One school of thought holds that all your automotive expenses — gas, insurance, car payments — should not exceed 20% of your pretax monthly income. Other. souzka.ru Managing Editor Mike Sante says you shouldn't spend more than 10 percent of your pretax income on the combined cost of car payments and auto. If you can afford it, then you should make a 20 percent down payment on your new automobile. For used cars, you should aim to pay no less than 10 percent of the. Based on recent data, the average monthly car payment in Canada ranges between $$ Keep in mind that this figure can vary depending on the. The calculator will give your estimated weekly, biweekly, or monthly payments and the cost of borrowing. Finance calculator. What can I afford? That puts average monthly car payments at $, $ and $, respectively. The price of used cars and trucks decreased. Used car and truck prices are down a. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. Total Loan Amount, $40, ; Sale Tax, $5, ; Upfront Payment, $18, ; Total of 60 Loan Payments, $45, ; Total Loan Interest, $5, Calculate your car loan payments · Your Estimated Monthly Fixed Rate Loan Payment is: · How much would you like to borrow.

Best Futures Trading Courses

Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. The BEST Futures Trading Course for All Levels () Welcome to The BEST Futures Trading Course for All Levels. Whether you're just starting out or have been. Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. The CScalp team has prepared a free futures trading course focused on how to trade futures on cryptocurrency exchanges. CME Group's Futures Fundamentals site includes articles and videos on how futures markets work and how to trade, and the CME Institute includes free online. Beginner Options Course · The difference between stocks and options · Common options strategies · Market metrics for choosing the ideal trading strategy · Basic. Learn Futures Trading, earn certificates with paid and free online courses from Waseda University and other top universities around the world. In summary, here are 10 of our most popular trading courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Machine. This list facilitates both paid and free resources to help you learn Futures and Options Trading. Also, it is suitable for newbies, intermediates, as well as. Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. The BEST Futures Trading Course for All Levels () Welcome to The BEST Futures Trading Course for All Levels. Whether you're just starting out or have been. Master the Trade: Futures is a course designed for new traders to increase their understanding of futures contracts and strategies for trading. The CScalp team has prepared a free futures trading course focused on how to trade futures on cryptocurrency exchanges. CME Group's Futures Fundamentals site includes articles and videos on how futures markets work and how to trade, and the CME Institute includes free online. Beginner Options Course · The difference between stocks and options · Common options strategies · Market metrics for choosing the ideal trading strategy · Basic. Learn Futures Trading, earn certificates with paid and free online courses from Waseda University and other top universities around the world. In summary, here are 10 of our most popular trading courses · Financial Markets: Yale University · Practical Guide to Trading: Interactive Brokers · Machine. This list facilitates both paid and free resources to help you learn Futures and Options Trading. Also, it is suitable for newbies, intermediates, as well as.

Master the core foundational concepts of futures trading with Online Trading Academy's core strategy of identifying demand and supply zones in live India. We chose E*TRADE as the best broker for futures education because the platform offers extensive content and training resources to help educate and prepare. Larry Williams Futures and Commodities Online Course. Larry Williams teaches how he trades the futures and commodities markets. Teaching videos, course. I recommend you take Futures Trader 71 Convergent foundational knowledge curriculum. Takes you from developing a business plan to understanding. Futures Trading students also learn · Technical Analysis (finance) · Derivatives Trading · Day Trading · Candlestick Trading · Stock Trading · Price Action. Learn Futures Trading, earn certificates with paid and free online courses from Waseda University and other top universities around the world. Futures Trading Basics - Learn to Trade Futures (Step-by-Step Course). This course provides content to suit investors with different levels of knowledge about the futures market. Investors new to the world of futures trading can. The BEST Futures Trading Course for All Levels () souzka.ru #financeandaccounting #investingandtrading #futurestrading. Our Futures course delivers this strategic edge by combining powerful skill-building lessons and hands-on live market trading classes. The trading resources and. Futures Trading Courses The Day Trading Academy (DTA) teaches traders how to deal with a variety of market conditions in the futures space, by tracking a. This course is a part of the Learning Track: Quantitative Trading in Futures and Options Markets · Options Trading Strategies In Python: Intermediate ₹ ₹. AXIA FUTURES is a trading education firm based in London offering trader training and trading courses that model the best practices and skills development. In this article we review six of the best courses available and offer guidance on how to choose the right one for your circumstances. CME Institute offers a variety of courses, helping you learn about futures and options, all of our asset classes, trading strategies, and more. Introduction. Bullish Bears community is a great educational resource for all type of traders. The best learning experience for the best price. Their educational platform is. Futures Trading Training Courses · Introduction to Commodity Futures · Benefits of Portfolio Diversification · Introduction to Technical Analysis · Trade and Risk. Futures Master Class - learn to trade futures from registered CTA and commodity broker. Learn how to trade prop-strategy and make up to $ a day trading. This free multi-video trading course introduces futures trading basics for new futures traders. It also provides a roadmap for all the key learning points. EDGE TOOL TRADING COURSES (SELF-GUIDED) · Trading with Price Ladder and Order Flow Strategies · Volume Profiling with Strategy Development · The Footprint Edge.

1 2 3 4 5