souzka.ru Tools

Tools

Wells Fargo Id Requirements To Open Account

When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Wells Fargo requirements · Pay stubs, W2s or tax returns · Utility bills (for address verification) · Driver's license or Social Security card · Account information. Minimum age to open. 17 or older. Must be 18 to open online. Age and ID requirements · Quick view of account fees. $25 minimum opening deposit. Learn more Open. If you want to see all 4 accounts, you need to use her user ID and her password. Upvote. What will I need to enroll?Expand · ATM/debit or credit card number or Wells Fargo account or loan number · Social Security or Tax ID number · Access to your email. What are the requirements to open a Wells Fargo account? Checking account: A checking account can be opened individually or jointly, and youll need your basic. Canadian driver's license or state-issued identification card, issued in English. For secondary identification: The secondary ID must contain either your. Birth Certificate. Social Security Card. Car Registration (address matches my ID). Will my printed Wells Fargo monthly bank statement (address. 17 and under must open at a branch. No matter how you apply, you'll need: Your Social Security number; Valid ID (driver's license, state ID, Consular ID). When opening a business checking or savings account, we are required by law to verify your business as well as the individuals associated with your business. Wells Fargo requirements · Pay stubs, W2s or tax returns · Utility bills (for address verification) · Driver's license or Social Security card · Account information. Minimum age to open. 17 or older. Must be 18 to open online. Age and ID requirements · Quick view of account fees. $25 minimum opening deposit. Learn more Open. If you want to see all 4 accounts, you need to use her user ID and her password. Upvote. What will I need to enroll?Expand · ATM/debit or credit card number or Wells Fargo account or loan number · Social Security or Tax ID number · Access to your email. What are the requirements to open a Wells Fargo account? Checking account: A checking account can be opened individually or jointly, and youll need your basic. Canadian driver's license or state-issued identification card, issued in English. For secondary identification: The secondary ID must contain either your. Birth Certificate. Social Security Card. Car Registration (address matches my ID). Will my printed Wells Fargo monthly bank statement (address. 17 and under must open at a branch. No matter how you apply, you'll need: Your Social Security number; Valid ID (driver's license, state ID, Consular ID).

Account Management •Access your cash, credit, and investment accounts with Fingerprint Sign On¹ or Biometric Sign on¹ •Review activity and balances. 2 Account must meet both account-level and package-level requirements to have monthly service fee waived. Minimum $ to open a new Wells Fargo checking. Your NYU ID card;; Any identification documents issued by your Wells Fargo at 66 Ninth Ave. at 15th St., HSBC at 9th St. and Broadway, 15th. This is usually required along with proof of residence in the US and other documentation proving your identity. However, not all banks require this. Some will. $ minimum daily balance · $ or more in total qualifying electronic deposits · The primary account owner is 17 - 24 years old · A linked Wells Fargo Campus. If you are not a Wells Fargo stockholder, you can make an initial investment in Wells Fargo common stock, starting with as little as $, or $25 if you sign up. requirements first, including providing additional pieces of identification. Wells Fargo. In addition, credit unions and banks connected to the BankOn. Once we verify your identity, we will provide personal data. Wells Fargo has collected about you and how we have used the personal data, subject to requirements. Wells Fargo checking account. Or order your UF Debit Card when you open your Wells Fargo checking account at a Wells Fargo branch in Florida. Find a branch. We may also ask to see a driver's license, passport or other identifying documents. When opening an account for a corporation, partnership, trust, or other. Valid ID (driver's license, state ID, Consular ID) 17 and under must open at a branch (refer to checking account details for minimum age requirements to open). If you're under 18, visit a branch to open an account. · Clear Access Banking · Everyday Checking. Instead of your SSN, they'll ask for an Individual Taxpayer Identification Number (ITIN) and other documents. As long as the necessary requirements are met, you. Your Social Security number; Valid ID (driver's license, state ID, Consular ID); Current residential address; $25 minimum opening deposit How do I open a. If you are having this document Notary: You may attach your own acknowledgement form if the language below does not meet your State requirement. In general, banks require government-issued photo identification to open a bank account, such as a driver's license, passport, or national ID. Expand. To change your name on your accounts, you will need to meet with a banker in your nearest Wells Fargo branch. Please bring your updated photo ID and an. DEBIT CARD & Pin can serve as an ID. For all of our customers who have a Wells Fargo Debit Card and pin number this can serve as their only ID needed when. 1. Gather Required Personal Information · Valid identification (driver's license, state ID or other government-issued ID) · Social Security number or tax ID. Account Management •Access your cash, credit, and investment accounts with Touch ID®¹ or Face ID®¹ •Review activity and balances •View your credit card.

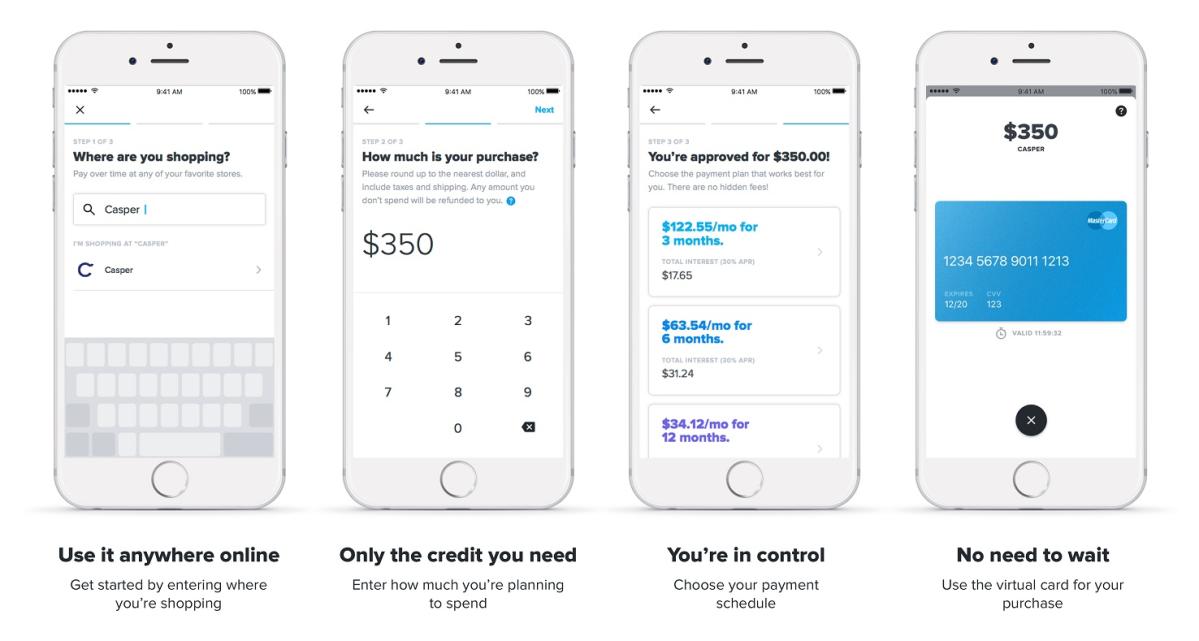

App Lends You Money

If you're on the market for a new mobile bank and also want to borrow $50 instantly, then Current should be on your radar. This fee-free mobile bank lets you. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Varo Cash Advance · Get up TO $ to COVER THAT · Borrow what you need. Right when you need it. · Borrow fast · SO, CAN I JUST BORROW $ RIGHT AWAY? Online lending networks are the ultimate loan application source because they allow you to submit a loan request to several lenders at once without incurring. Chime is an online banking app that lets you access cash – even when funds are low – if you have a checking account that's set up with a direct deposit. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. If you're on the market for a new mobile bank and also want to borrow $50 instantly, then Current should be on your radar. This fee-free mobile bank lets you. Kiva is the world's first online lending platform. For as little as $25 you can lend to an entrepreneur around the world. Learn more here. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. Looking for the best mobile banking app? Millions of people use Dave for cash advances, side hustles, and banking accounts with fewer fees. Make the switch! Varo Cash Advance · Get up TO $ to COVER THAT · Borrow what you need. Right when you need it. · Borrow fast · SO, CAN I JUST BORROW $ RIGHT AWAY? Online lending networks are the ultimate loan application source because they allow you to submit a loan request to several lenders at once without incurring. Chime is an online banking app that lets you access cash – even when funds are low – if you have a checking account that's set up with a direct deposit. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees.

[NEW] Short on cash? We've got your back. Use these 12 apps to bridge cash flow gaps and access your wages before payday. Get Cash Advance up to $* and repay automatically when you next get paid. No interest, no late fees, no risk to your credit. GET APP. JOIN EMPOWER. The Payactiv app puts you in control of your earning, spending, and saving so you can access your pay when you need it, stretch every dollar, and achieve your. Make the most of your money with LendingClub, recently awarded Best Online Bank for by GOBankingRates. Our superior products and services are built to help. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. These apps ensure a. The Mooch app lets you lend, borrow, and track your stuff with a private group of friends to save money, reduce waste, and have more community. Our simple, flexible money solutions make getting loan easy and your cash accessible both online and in-store. whether you need a loan or simply cash your check. An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · Getting Started Is Easy · Simple Loans Between Family, Friends, and People You Trust · Ready To. The money you need, when you need it. Get 24/7 access to cash advances with Close up view of the Product & Offers section in the Fifth Third mobile app. When you use Dave, you have to link your bank account, but you don't need to have direct deposit. Dave can help you out in a financial pinch by offering a boost. Best Loan Apps Of September ; BEST OVERALL LOAN APP FOR CASH ADVANCES. EarnIn. EarnIn ; BEST FOR ALL-IN-ONE BANKING. Chime®. Chime® ; BEST FOR CHECKING AND. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. Cash advance apps – also called payday advance apps – allow you to borrow money in advance of your paycheck. If you are considering using a cash advance app. A copy of the Cash App Terms of Service, and related policies, can be found here. If you're needing your cash fast, start your application with Gerald. You can get your account set up in just minutes and get approved instantly. Your money. Without prior enrollment or setup, EarnIn or MoneyLion are the fastest cash advance apps, offering setup and funding the same day. If you already have Payactiv. Another online banking app that offers a combination of early cash advances and early paycheck access is MoneyLion. Its Instacash feature lets you borrow up to. ✓ EarnIn: Distinguished by its unique model that allows users to access earned wages ahead of payday, EarnIn offers a free cash advance app. Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely link your bank, and send the money to. Lenme allows lenders the ability to lend without the high costs needed to maintain a shop, staff, verify and qualify borrowers, and manage loans.

Is Food Tax Deductible Self Employed

The tax code provides for a 50% deduction of meals related to business activity, like taking a potential client out for coffee or dinner. Your professional. The general answer is no, however there still seems to be lots of conflicting opinions. Lots of people will say they've been writing their meals. If you're self-employed, you can deduct the cost of business meals and entertainment as a work expense when filing your income tax. The cost of business meals. The employee wage portion is taxed at the higher self-employment rate, but the remainder is treated as distributions of profits from your business. The good. Self-employment for food assistance purposes involves a The Internal Revenue Service (IRS) allows self-employed persons to deduct depreciation as a. Disallowed Self-Employment Expenses · Charitable contributions · Dependent care – allowed as a dependent care deduction · Funds for the owner's retirement or. All types of self-employed people should claim business lunches. In this guide, we'll cover everything you need to know about writing off meals: what to. Going out for dinner by yourself is also non-deductible, unless you are travelling for a legitimate business purpose. The meal must be with an employee of the. You can deduct 50% of the cost of meals that are not extravagant and were either primarily for the purpose of conducting business or took place. The tax code provides for a 50% deduction of meals related to business activity, like taking a potential client out for coffee or dinner. Your professional. The general answer is no, however there still seems to be lots of conflicting opinions. Lots of people will say they've been writing their meals. If you're self-employed, you can deduct the cost of business meals and entertainment as a work expense when filing your income tax. The cost of business meals. The employee wage portion is taxed at the higher self-employment rate, but the remainder is treated as distributions of profits from your business. The good. Self-employment for food assistance purposes involves a The Internal Revenue Service (IRS) allows self-employed persons to deduct depreciation as a. Disallowed Self-Employment Expenses · Charitable contributions · Dependent care – allowed as a dependent care deduction · Funds for the owner's retirement or. All types of self-employed people should claim business lunches. In this guide, we'll cover everything you need to know about writing off meals: what to. Going out for dinner by yourself is also non-deductible, unless you are travelling for a legitimate business purpose. The meal must be with an employee of the. You can deduct 50% of the cost of meals that are not extravagant and were either primarily for the purpose of conducting business or took place.

The rules also state that either the owner or an employee of the business claiming the % deduction must be present when the food or beverages are provided by. Self-employed clients may deduct some travel, transportation and entertainment expenses incurred for their self-employed business. Self-employed clients may deduct some travel, transportation and entertainment expenses incurred for their self-employed business. Disallowed Self-Employment Expenses · Charitable contributions · Dependent care – allowed as a dependent care deduction · Funds for the owner's retirement or. If your meal is eligible, you're entitled to a tax deduction. Depending on the nature of the meal, you can write off % or 50% of the cost of the meal. As a self-employed worker, you are treated as a business by the IRS. It's important to understand the tax implications of your side (or full-time) gig. Food. The tax code does allow for certain meals to be deducted as business expenses, typically at a 50% rate. However, the rules can be complex. When computing profit, the CAO must allow deductions for the verified costs of doing business. If the household does not verify a business expense, the CAO must. Employee Business Meals: If you provide meals for employees while they are traveling for business or working late, the cost of those meals can be tax-. An ordinary meal taken during your lunch break is not deductible unless you're traveling and cannot eat the meal within a reasonable distance of your tax home. Meals considered necessary and directly related to your business activities while away from your tax home are 50% tax-deductible. This includes meals with. Meals with employees or business partners are only deductible if there is a direct or indirect business purpose. Meal expense that are % deductible. Additionally, self-employed workers can deduct the cost of repairs and maintenance for printers and other office equipment. Software Expenses. Software used. The good news is that everything counts: food, drinks, tax, and tip. The bad news? Meal costs typically are considered entertainment expenses, which generally. If you are a sole proprietor / self employed, you can only use the Per Diem rate for meals and incidental expenses. You cannot use the Per Diem rate to deduct. In such cases, keeping grocery receipts can help you substantiate these expenses when claiming tax deductions. Home Office Deduction: For self-employed. As of tax year , you can deduct 50% of the cost of meals for business activities. If you travel to see a client during the day but return home in the. The good news is that the IRS considers the employer portion of the self-employment tax as a business expense, so you can deduct half of it. 3. Home office. While the Internal Revenue Service (IRS) doesn't have a pre-approved list of expenses that you can definitely deduct, you'll know that a purchase is deductible.

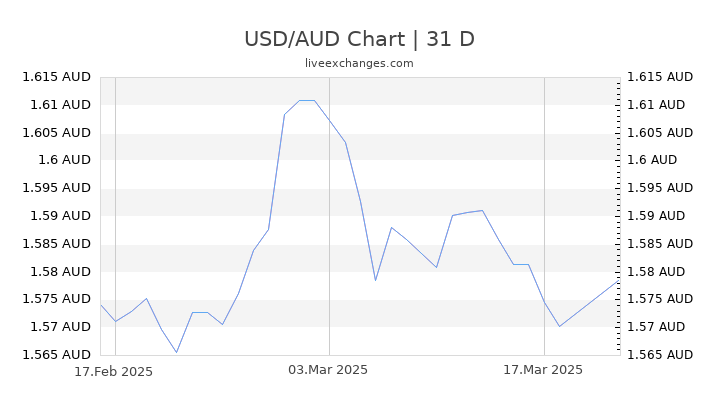

Real To Usd Conversion

Calculator to convert money in Brazilian Real (BRL) to and from United States Dollar (USD) using up to date exchange rates. So if it costs a U.S. dollar holder $ to buy one To do this, economists usually measure the real exchange rate in terms of a broad basket of goods. Conversion rates Brazilian Real / US Dollar. 1 BRL, USD. 5 BRL, USD. 10 BRL, USD. 20 BRL, USD. 50 BRL, USD. BRL. Latest Currency Exchange Rates: 1 US Dollar = Brazilian Real · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Brazilian Reals . Conversion Rates US Dollar/Brazilian Real. US Dollar, Brazilian Real. 1 USD, BRL. 5 USD, BRL. 10 USD, BRL. 15 USD, BRL. 20 USD. Current exchange rate US DOLLAR (USD) to BRAZIL REAL (BRL) including currency converter, buying & selling rate and historical conversion chart. Convert Brazilian Real to US Dollar ; 1 BRL, USD ; 5 BRL, USD ; 10 BRL, USD ; 25 BRL, USD. 1 Dólar dos Estados Unidos/USD () = Real/BRL (). The USD exchange rate. expand_less. To ensure the stability of the currency. The exchange rate for Brazilian real to US dollars is currently today, reflecting a % change since yesterday. Over the past week, the value of. Calculator to convert money in Brazilian Real (BRL) to and from United States Dollar (USD) using up to date exchange rates. So if it costs a U.S. dollar holder $ to buy one To do this, economists usually measure the real exchange rate in terms of a broad basket of goods. Conversion rates Brazilian Real / US Dollar. 1 BRL, USD. 5 BRL, USD. 10 BRL, USD. 20 BRL, USD. 50 BRL, USD. BRL. Latest Currency Exchange Rates: 1 US Dollar = Brazilian Real · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Brazilian Reals . Conversion Rates US Dollar/Brazilian Real. US Dollar, Brazilian Real. 1 USD, BRL. 5 USD, BRL. 10 USD, BRL. 15 USD, BRL. 20 USD. Current exchange rate US DOLLAR (USD) to BRAZIL REAL (BRL) including currency converter, buying & selling rate and historical conversion chart. Convert Brazilian Real to US Dollar ; 1 BRL, USD ; 5 BRL, USD ; 10 BRL, USD ; 25 BRL, USD. 1 Dólar dos Estados Unidos/USD () = Real/BRL (). The USD exchange rate. expand_less. To ensure the stability of the currency. The exchange rate for Brazilian real to US dollars is currently today, reflecting a % change since yesterday. Over the past week, the value of.

US Dollar to Brazilian Real conversion rate Exchange Rates shown are estimates, vary by a number of factors including payment and payout methods, and are. Our Brazilian Real to Dollar conversion tool gives you a way to compare the latest and historic interbank exchange rates for BRL to USD · Currency Menu. Stocks in Translation · NEXT · Lead This Way · Good Buy or Goodbye? ETF Brazil's real weakens past per dollar for first time since May. Reuters. To convert from U.S. dollars to foreign currency, multiply the U.S. dollar Real, , , , , Canada, Dollar, , , , BRL to USD Conversion Table ; 1 Brazilian Real, United States Dollar ; 2 Brazilian Real, United States Dollar ; 3 Brazilian Real. exchange rate of the U.S. dollar to the cruzeiro real on that day. As a consequence, the real was worth exactly one U.S. dollar as it was introduced; that. BRL/USD - Brazil Real US Dollar ; (%). Real-time Data 10/09 ; Day's Range. 52 wk Range. 1 USD = BRL Sep 10, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. BRL · In , the Brazilian real replaced the cruzeiro real at the rate of 1 Brazilian real to 2, cruzeiro reals, the average exchange rate of the US dollar. Brazilian Real Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Indian Rupee. Convert Brazilian Real to US Dollar with Western Union. Learn about our international sending and receiving services! Quick Conversions from Brazilian Real to United States Dollar: 1 BRL = USD ; R$ 1, US$ ; R$ 5, US$ ; R$ 10, US$ ; R$ 50, US$ Latest Currency Exchange Rates: 1 Brazilian Real = US Dollar · Currency Converter · Exchange Rate History For Converting Brazilian Reals (BRL) to Dollars . 1 Brazilian Real = US Dollars as of September 10, AM UTC. You can get live exchange rates between Brazilian Reals and US Dollars using. US Dollars to Brazilian Reais conversion rates ; 1 BRL, USD ; 5 BRL, USD ; 10 BRL, USD ; 25 BRL, USD. The currency calculator provides an ideal tool for investors investing in international stock exchanges with different currencies. Conversion from Brazilian. The currency calculator provides an ideal tool for investors investing in international stock exchanges with different currencies. Conversion from United States. This Free Currency Exchange Rates Calculator helps you convert US Dollar to Brazilian Real from any amount. With our unique currency converter you can easily and quickly convert currencies with many advantages: All foreign currencies of the world, gold price and. Brazilian Reals to Dollars Currency Converter ; FOREX DATA ; BRL/USD, +0 ; , △, +0%.

Nnup Stock

NNUP Nocopi Technologies, Inc. $ $ (%). Today. Watchers, Wk Low, $ Wk High, $ Market Cap, $M. Volume, Short interest for Nocopi Technologies gives investors a sense of the degree to which investors are betting on the decline of Nocopi Technologies's stock. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume3, · Dividend- · Dividend Yield- · Beta · YTD % Change NNUP, $NNUP, stock technical analysis with charts, breakout and price targets, support and resistance levels, and more trend analysis indicators. NNUP | Complete Nocopi Technologies Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Get stock and bond quotes, trade prices, charts and more for Nocopi Technologies, Inc. NNUP. Discover real-time Nocopi Technologies Inc MD Com (NNUP) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. PROFILE (NNUP). Nocopi Technologies, Inc. engages in the development and distribution of document security products and licensing of reactive ink technologies. Nocopi Technologies' stock was trading at $ at the beginning of the year. Since then, NNUP stock has decreased by % and is now trading at $ View. NNUP Nocopi Technologies, Inc. $ $ (%). Today. Watchers, Wk Low, $ Wk High, $ Market Cap, $M. Volume, Short interest for Nocopi Technologies gives investors a sense of the degree to which investors are betting on the decline of Nocopi Technologies's stock. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume3, · Dividend- · Dividend Yield- · Beta · YTD % Change NNUP, $NNUP, stock technical analysis with charts, breakout and price targets, support and resistance levels, and more trend analysis indicators. NNUP | Complete Nocopi Technologies Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Get stock and bond quotes, trade prices, charts and more for Nocopi Technologies, Inc. NNUP. Discover real-time Nocopi Technologies Inc MD Com (NNUP) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. PROFILE (NNUP). Nocopi Technologies, Inc. engages in the development and distribution of document security products and licensing of reactive ink technologies. Nocopi Technologies' stock was trading at $ at the beginning of the year. Since then, NNUP stock has decreased by % and is now trading at $ View.

Nocopi Technologies Inc MD (QB) stock quote and NNUP charts. Latest stock price today and the US' most active stock market forums. Get Nocopi Technologies Inc (souzka.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Webull offers NNUP stock news, real time Nocopi Technolog news help you invest smart. Find the latest Nocopi Technologies, Inc. (NNUP) stock quote, history, news and other vital information to help you with your stock trading and investing. Nocopi Technologies Inc. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume12, · Dividend- · Dividend Yield- · Beta · YTD % Change NOCOPI TECHNOLOGIES, INC. NNUP | stock. $ %. $ K. %. $ - Best Dividend Stocks Best Dividend Capture Stocks High Yield Stocks Ex-Dividend. Earnings announcements can affect a stock's price. This table shows the stock's price the day before and the day after recent earnings reports, including the. Stock Ideas · Market Outlook · Investing Strategy · Long Ideas · IPO Analysis NNUP Valuation Grade. view ratings. Type. Grade. NNUP. Sector Median. % Diff. to. Nocopi Technologies, Inc. (NNUP) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. As of August 03, Saturday current price of NNUP stock is $ and our data indicates that the asset price has been in a downtrend for the past 1 year (or. Check if NNUP Stock has a Buy or Sell Evaluation. NNUP Stock Price (PINK), Forecast, Predictions, Stock Analysis and Nocopi Technologies, Inc. News. Learn more about Nocopi Technologies, Inc.'s (NNUP) stock grades for Momentum and Growth and determine whether this Business Support Supplies stock meets. Nocopi Technologies Stock Buy Hold or Sell Recommendation · OTC Stocks. USA. Given the investment horizon of 90 days and your above-average risk tolerance. Research Nocopi Technologies' (OTCPK:NNUP) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance. View NOCOPI TECHNOLOGIES INC (NNUP) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Stock; NNUP; Company Profile. NNUP. Nocopi Technologies, Inc. Common Stock. %. / ( x ). Real-Time Best Bid & Ask: pm 08/23/. Volume, Market Value, $M. Shares Outstanding, M. EPS (TTM), -$ P/E Ratio (TTM), N/A. Dividend Yield, N/A. Latest Dividend, N/A. Stock analysis for Nocopi Technologies Inc (NNUP:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Nocopi Technologies Inc. advanced stock charts by MarketWatch. View NNUP historial stock data and compare to other stocks and exchanges.

Balance Transfer Fee Or Low Apr

Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can. When the 0% introductory rate period is over, and it always ends, the credit card will revert to its regular APR. This rate might not be low at all. It may. Wells Fargo Reflect® Card · · 0% intro APR for 21 months from account opening on qualifying balance transfers ; Blue Cash Everyday® Card from. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. A balance transfer credit card allows you to move debt from a typical credit card, often with a double-digit interest rate, to one with a lower APR (annual. Lower your interest rate by 2% each year. You will automatically be considered for an APR reduction by 2% when you pay on time and spend at least $1, on. After that, %, % or % variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is. A balance transfer can allow you to reduce the interest rate on your credit card debt. If you have credit card debt on a high annual percentage rate (APR). Are you looking for a temporary break from APR? One of the balance transfer credit card offers available on Bankrate could help you pay down. Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can. When the 0% introductory rate period is over, and it always ends, the credit card will revert to its regular APR. This rate might not be low at all. It may. Wells Fargo Reflect® Card · · 0% intro APR for 21 months from account opening on qualifying balance transfers ; Blue Cash Everyday® Card from. Moving high-interest debt to a credit card with 0% APR can be a big money-saver! Generally, you'll have to pay a balance transfer fee — usually, 3% to 5% of the. A balance transfer credit card allows you to move debt from a typical credit card, often with a double-digit interest rate, to one with a lower APR (annual. Lower your interest rate by 2% each year. You will automatically be considered for an APR reduction by 2% when you pay on time and spend at least $1, on. After that, %, % or % variable APR based on your creditworthiness. There is a balance transfer fee of $5 or 3% of each transfer, whichever is. A balance transfer can allow you to reduce the interest rate on your credit card debt. If you have credit card debt on a high annual percentage rate (APR). Are you looking for a temporary break from APR? One of the balance transfer credit card offers available on Bankrate could help you pay down.

Paying a balance transfer fee is usually worth it if you choose a balance transfer credit card that offers a 0% intro APR on balance transfers — with this. Say you want to transfer $9, from a card with a 22% APR to a card with a promotional APR of 0% for 12 months with a 3% balance transfer fee. You can. In general, the 0% interest offers come with a 3–4% balance transfer fee. On a $10, balance transfer, you would pay $ for the balance. The idea is that the lower rate will save you money on interest. The best balance transfer credit cards usually come with no annual fee and a 0% intro APR. You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. Many balance transfer credit cards offer no-interest periods for new purchases as well as balances transferred from other debt. Others only offer a 0% intro APR. Sick of high-interest finance charges? Transfer your high-interest balance to a low-interest credit card. Save on finance charges with a flat rate of % APR*. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. Because credit card charges are unsecured loans, financial institutions are able to charge high interest. However, a balance transfer can allow card holders to. A balance transfer is when you move your balance from one credit card to another offering a lower or 0% annual percentage rate (APR) for a set period of time. Many balance transfer credit cards feature a low or 0% introductory APR, allowing you to save money on interest payments. The low interest rates on balance. Some balance transfer cards come with an introductory 0% APR for a set amount of time. That way the money you do put toward your debt is not just getting eaten. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. A one-time balance transfer fee like this could end up costing you more than a low APR with no fees. Some financial institutions, like Navy Federal Credit Union. Transferring a credit card or loan balance to a new credit card with a lower APR is a helpful step toward paying down your debt, but be sure to understand. Wells Fargo Reflect® Card: Best feature: Lengthy low introductory APR. Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Some credit cards that offer balance transfers provide new cardholders a 0% annual percentage rate (APR) during an introductory period of anywhere from 6 to Most balance transfer fees range from 3%-5%. What's the big deal? Well, it adds $30 to $50 to every $1, you transfer. The point of this is to save money. %, % or % variable APR thereafter. Balance transfers made within days from account opening qualify for the introductory rate. Annual fee. $0. Many balance transfer credit cards feature a low or 0% introductory APR, allowing you to save money on interest payments. The low interest rates on balance.

3 4 5 6 7